Guess What Turned 100 This Weekend?

Daily News Article — Posted on February 6, 2013

(by Kelly Phillips Erb, Forbes) – …This week marks the official birthday of our modern day tax system. On February 3, 1913, Delaware became the 36th state to ratify the 16th Amendment, ushering in a new federal income tax. Alabama was the first, followed by a slew of mostly southern states including Kentucky, South Carolina,Mississippi, Oklahoma, Maryland, Georgia and Texas. Midwestern states Illinois and Ohio rounded out the top ten.

(by Kelly Phillips Erb, Forbes) – …This week marks the official birthday of our modern day tax system. On February 3, 1913, Delaware became the 36th state to ratify the 16th Amendment, ushering in a new federal income tax. Alabama was the first, followed by a slew of mostly southern states including Kentucky, South Carolina,Mississippi, Oklahoma, Maryland, Georgia and Texas. Midwestern states Illinois and Ohio rounded out the top ten.

Taxation was nothing new to the U.S. by the time the new tax system took place. [Apprehensive] of taxes under the royal rule, the Founding Fathers nonetheless granted the right to the federal government to impose taxes under the Constitution. The right went largely ignored as it applied to individuals and taxes were more or less restricted to tariffs.

But a shot fired upon Fort Sumter in 1861 changed all that. With the advent of the Civil War, the federal government found itself in a need for cash. As we know, wars are expensive. And so, the first federal income tax was adopted as part of the Revenue Act of 1861. The tax was a flat 3% on annual income of more than $800 (just under $20,000 in today’s dollars). The next year, the flat tax was replaced by a graduated tax beginning at 3% for income of more than $600 (just over $13,000 in today’s dollars) and climbing to 5% for incomes over $10,000 (nearly a quarter of a million dollars in today’s dollars). Revenues from the tax allowed the Union to keep its troops fed and well-supplied; by the time the Confederacy fine-tuned its own system of taxation in 1864, it was too late to contribute much to the war effort. The war ended in 1865 and the tax, which had continued to climb as the war raged on, brought in nearly $310 million to the Treasury (nearly $5 billion in today’s dollars).

Post-Civil War, however, the nation was tired and large segments of the population – especially in the South – were impoverished. Congress allowed the income tax to expire and focused, instead, on tariffs on products like tobacco and liquor.

However, as the nation struggled to recover from the Civil War – and looked likely to be pulled into another war – the U.S. experienced the worst economic depression of its short history. Accelerated by an over-exuberant market and bank failures (sound familiar?), the Panic of 1893 forced Congress’ hand once again: income taxes were re-instituted in 1894. A year later [in 1895], the U.S. Supreme Court, led by Chief Justice Melville Fuller, declared on a…vote of 5-4 that law to be unconstitutional. The case that led to the ruling, Pollock v. Farmers’ Loan and Trust Company, … focused on a Massachusetts man, Charles Pollock, who sued Farmers’ Loan & Trust Company to prevent it from paying the tax on his stock shares. The Supreme Court ruled in the case that income taxes on interest, dividends and rents were direct taxes and were, therefore, unconstitutional because they violated the Constitutional provision that direct taxes be apportioned. That was a first for Congress: in the four cases regarding income tax brought before the Court, not one had ever struck down a law as unconstitutional.

It was back to the drawing board for Congress.

Interestingly, income derived from wages and salaries were not included in the ruling. Those had already been declared constitutional; rather, it was the specific case of income taxes on property (in this case, interest, dividends and rents) that caught the Court’s attention. Taxes derived from property were considered to be direct taxes while indirect taxes were those on labor and services. The only way to “fix” the disparity was to have Congress amend the Constitution to be able to tax income from any source without apportionment.

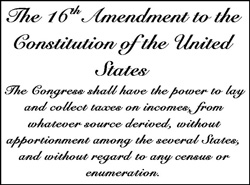

And that’s exactly what the 16th Amendment did. The Amendment reads:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.

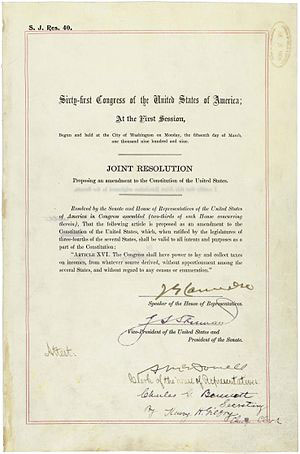

An uneasy Congress, under President William H. Taft, passed the new income tax law in 1909. It would take four years to get the necessary number of states to ratify the amendment. Eventually, forty-two of the forty-eight states would ratify the amendment (Alaska and Hawaii didn’t exist, Florida and Pennsylvania refused to consider it and Connecticut, Rhode Island, Utah and Virginia voted no). By law, a proposed amendment becomes part of the Constitution as soon as it is ratified by three-fourths of the States. At the time, 36 states were needed; 38 of 50 states would be needed to ratify the Constitution today.

An uneasy Congress, under President William H. Taft, passed the new income tax law in 1909. It would take four years to get the necessary number of states to ratify the amendment. Eventually, forty-two of the forty-eight states would ratify the amendment (Alaska and Hawaii didn’t exist, Florida and Pennsylvania refused to consider it and Connecticut, Rhode Island, Utah and Virginia voted no). By law, a proposed amendment becomes part of the Constitution as soon as it is ratified by three-fourths of the States. At the time, 36 states were needed; 38 of 50 states would be needed to ratify the Constitution today.

It is the stuff of conspiracy theories. The lengthy process to ratify the Sixteenth Amendment gave rise to a number of suggestions that it was never actually ratified, making our federal income tax system a hoax. The matter has been discussed and feuded and yes, even litigated, a number of times. The Internal Revenue Service eventually issued Rev. Ruling 2005-19 deeming that argument to be a frivolous tax position; making this claim can subject taxpayers to a penalty of up to $25,000.

Today, taxpayers can thank (*ahem*) President Taft and the 61st Congress for making history. But the Sixteenth Amendment wasn’t the only news item in 1913. That year also saw the first minimum wage law take effect in the US (Oregon); the first presidential press conference (President Woodrow Wilson, who succeeded President Taft); the U.S. Post office began making parcel post deliveries; and perhaps most important, the first prize in a Cracker Jack box.

Reprinted here for educational purposes only. May not be reproduced on other websites without permission from Forbes.com.

Questions

1. Define the following terms used in the article:

- tax

- 16th Amendment

- federal income tax

- tariff

- impoverished

- re-instituted

- apportioned

- direct taxes

- indirect taxes

2. a) When was the first federal income tax adopted in the U.S.?

b) What percentage rate did people have to pay on their annual income at that time?

c) How did it change the following year?

3. Why did Congress allow the first federal income tax to expire?

4. a) Why were federal income taxes re-instituted in 1894?

b) On what grounds was the law overturned a year later? Be specific.

5. a) Write out the text of the 16th Amendment.

b) How many states must ratify a proposed amendment for it to become part of the Constitution?

6. Ask a parent what the tax rate is for your family.

7. Ask a parent if he/she supports a federal income tax, and if so, at what rate should people be taxed? Flat tax, sales tax only, the current system, impose higher taxes on "the rich" (and if so, what yearly income makes a person rich)?